Mortgage calculator without email

Pop up mortgage calculator. How to use the mortgage payment calculator.

Mortgage App Calculator Mortgage Calculator App Mortgage Calculator App

Choose mortgage calculations for any number of years months amount and interest rate.

. The calculator will now show you what your mortgage payments will be. Rates are subject to change without notice. The mortgage points calculator will help you to calculate whether or not it is going to be beneficial for you to buy mortgage points or not.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. The mortgage amortization schedule shows how much in principal and interest is paid over time. We considered all applicable closing costs including the mortgage tax transfer tax and both fixed and variable fees.

Please contact First National at 4165931100 or toll-free at 18886702111 or email a Mortgage Specialist for further information. This requires little sacrifice but reaps huge savings as you can see when you input your mortgage payment information into this Bi-Weekly Mortgage Calculator. The Loan term is the period of time during which a loan must be repaid.

7 traits worth modelling when sorting your money life Insurance. Contact our support if you. Our calculator includes amoritization tables bi-weekly savings.

How to save without feeling youre missing out Money mindset. If you are seeking a loan for a format without a front-end limit you can set the front-end box to 100 for 100 so that the calculator bases your loan limit on the back-end limit you enter. Such as a one-time upfront mortgage insurance premium MIP and annual premiums paid monthly.

Mortgage payment calculator Predict your monthly mortgage payments. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current loan rates more. 5 tips to skip it Money mindset.

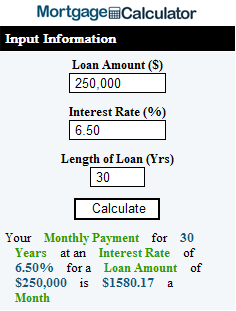

Annual interest rate for this mortgage without purchasing any discount points. Enter your information below to see your personal calculation. For example a 30-year fixed-rate loan has a term of 30 years.

Before you start bi-weekly payments make sure. The calculator shows the best rates available in your province but you can also add a different rate. Once we calculated the typical closing costs in each county we divided that figure by the countys median home value to find.

Dont have a mortgage and want to find out what your repayments could be and how long it could take to pay it off. Using our calculator above. For example a 30-year fixed-rate loan has a term of 30 years.

This is the cost of the home minus the down payment. Also offers loan performance graphs biweekly savings comparisons and easy to print amortization schedules. Are Bi-Weekly Payments Right For You.

For example lets say youre considering purchasing a 250000 home and putting 20 percent down. Our Closing Costs study assumed a 30-year fixed-rate mortgage with a 20 down payment on each countys median home value. If the property is located in a city or town that has mortgage tax youll pay an additional 25 to 50 cents.

We do not engage in direct marketing by phone or email towards consumers. Conforming Fixed-Rate estimated monthly payment and APR example. Spending to look the part.

A 225000 loan amount with a 30-yea r term at an interest rate of 3875 with a down-payment of 20 would result in an estimated principal and interest monthly payment of over the full term of the loan with an Annual Percentage Rate APR of 3946. This FHA loan calculator provides customized information based on the information you provide. Calculate total monthly mortgage payments on your home with taxes and insurance.

A Fixed-rate mortgage is a home loan with a fixed interest rate for the entire term of the loan. Is approaching 400000 and interest rates are hovering around 3. The Loan term is the period of time during which a loan must be repaid.

Download our FREE Reverse Mortgage Amortization Calculator and edit future appreciation rates interest rates and even future withdrawals. According to the Mortgage Bankers Association the average size of new 30-year mortgages in the US. Expressly consenting to receive information by email or phone via automated dialing systems texting andor prerecorded messages from or on behalf of Finance of America Reverse LLC and its fulfillment partners and may agree to.

An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan. See how those payments break down over your loan term with our amortization calculator. To use the calculator start by entering the purchase price then select an amortization period and mortgage rate.

I consent to being contacted by All Reverse Mortgage and its partners for marketing purposes at any phone number or email I provide including through the use of automated technology and prerecorded. An Adjustable-rate mortgage ARM is a mortgage in which your interest rate and monthly payments may change periodically during the life of the loan. Mortgage Amount or current balance.

The limit is usually either a percentage of your normal monthly payment eg you can only pay 20 more per month or a percentage of your outstanding balance eg. It includes advanced features like amortization tables and the ability to calculate a loan including property taxes homeowners insurance property mortgage insurance. Start by entering the mortgage amount.

The FHA mortgage calculator includes additional costs in the estimated monthly payment. The state tax is 50 cents per 100 of mortgage debt plus an additional special tax of 25 cents per 100 of mortgage debt. For your convenience current Redmond mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

Based on term of your mortgage interest rate loan amount annual taxes and annual insurance calculate your monthly payments. But it assumes a few things about you. Check out the webs best free mortgage calculator to save money on your home loan today.

Many mortgage lenders let you make some overpayments without charging you a fee for doing so. To calculate how long it will take for the mortgage holder to pay off the average mortgage set up the calculator this way. Example Required Income Levels at Various Home Loan Amounts.

New York City Yonkers and several other cities also impose a local tax on mortgages in those jurisdictions. There is usually a limit to this though and if you overpay by more you may be charged.

How Much House Can I Afford Insider Tips And Home Affordability Calculator Mortgage Calculator Mortgage Mortgage Payment

Free Mortgage Calculator Free Financial Tools Transunion

Interest Only Mortgage Calculator

Mortgage Calculator Script Free Mortgage Calculator Widget

Mortgage Calculator How Much Monthly Payments Will Cost

How To Create An Auto Loan Car Payment Calculator In Wordpress Car Payment Calculator Car Loans Amortization Schedule

Down Payment Calculator Buying A House Mls Mortgage Free Mortgage Calculator Mortgage Payment Calculator House Down Payment

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

When Saved Successfully You Can Retrieve It By Clicking On The Red Button Retrieve Usda Loan Mortgage Calculator Mortgage

Free Mortgage Calculator Free Financial Tools Transunion

Pin On Ux Ui Design

Mortgage Related Calculators Credit Karma

15 Year Vs 30 Year Mortgage 30 Year Mortgage Mortgage Payment Budgeting

Easily The Largest Sum Of Money You Ll Ever Pay In Your Life Is Interest Charged On Your Home Loan Anyone Sitting On The Sideline Home Loans Home Buying Loan

Loan Calculator On Behance Calculator Design Loan Calculator Calculator

Get A Free Mortgage Broker Layout Pack Mortgage Brokers Mortgage Marketing Mortgage Humor

Mortgage Repayment Calculator