Diminishing value depreciation calculator

Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. 264 hours 52 cents 13728.

Depreciation Calculation

2000 - 500 x 30 percent 450.

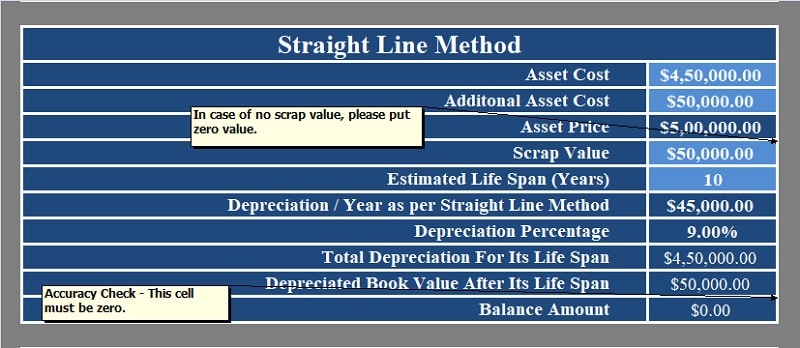

. Depreciation Calculator is a ready-to-use excel template to calculate Straight-Line as well as Diminishing Balance Depreciation on TangibleFixed Assets. Calculate depreciation for a business asset using either the diminishing. When using the diminishing value method you would.

To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. Carpet has a 10-year effective life and you could calculate the diminishing value depreciation as follows. Using the same example where the asset has cost 80000 and has an effective life of 5 years the method to calculate diminishing value depreciation is as shown below.

How to Calculate Depreciation Value of Car After An Accident. We already depreciated our car by 600 in the first year above. Car 1 and Car 2 are.

Depreciation Expenses Net Book. Year 2 2000 400 1600 x. If your car was originally worth 15000 was involved in a minor accident with minor damage to the structure and panels and had 24000 miles on it the 17c calculation would look like this.

We normally calculate depreciation on balance day which is the last day of the financial year. Year 1 2000 x 20 400. This means the current value of our car is considered to be 2400 3000 600 2400.

Pre-purchase Inspection - Free Consultation -Available Weekends - Call Now. Depreciation rate finder and calculator. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

NADVAs diminished value calculator provides a fast free onscreen claim estimate. The template displays the. Another common method of depreciation is the diminishing value method.

Diminished value also known as inherent diminished value is most easily explained with a scenario. Use the diminishing balance depreciation method to calculate depreciation expenses. Cost value 10000 DV rate 30 3000.

Ad Insurance Total Loss Dispute Settlement - Diminished Value Claims. Our software was developed by some of our professionally certified. The smart depreciation calculator that helps to calculate depreciation of an asset over a specified number of years also estimate car property depreciation.

The depreciation rate is 60. You can use this tool to. Option 1 - 1995 - Basic on-screen indication of the diminished value your vehicle has incurred.

Plugging these figures into the diminishing value depreciation rate formula gives the following depreciation expense. Well here is the formula. This is the value.

Prime cost straight line method. Under the prime cost method also known as the straight-line method you claim a fixed amount each year based on the following formula. Option 2 - 6995 - Professionally formatted printable report for.

Find the depreciation rate for a business asset.

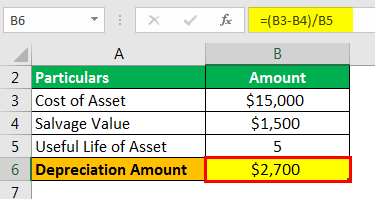

Depreciation Formula Calculate Depreciation Expense

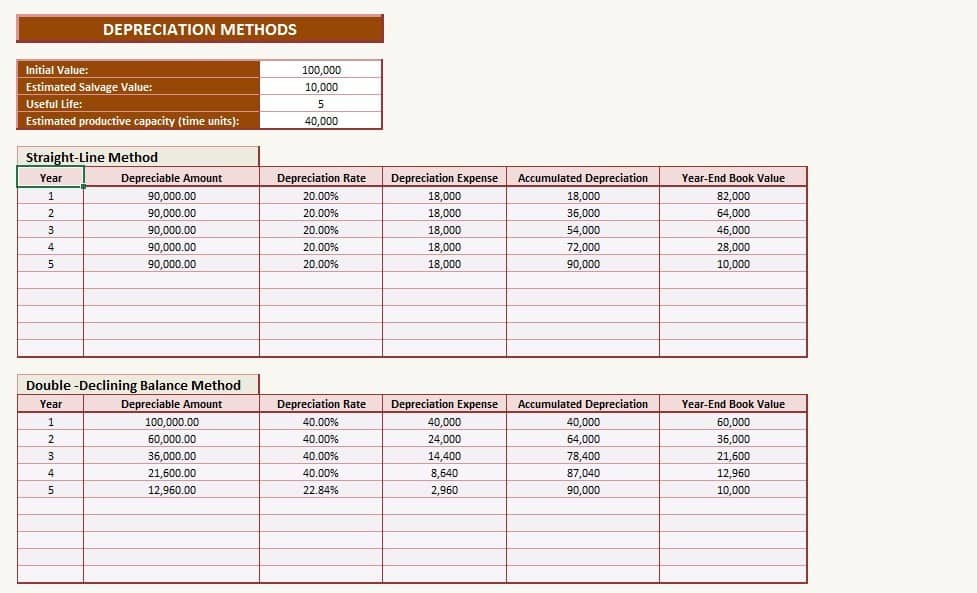

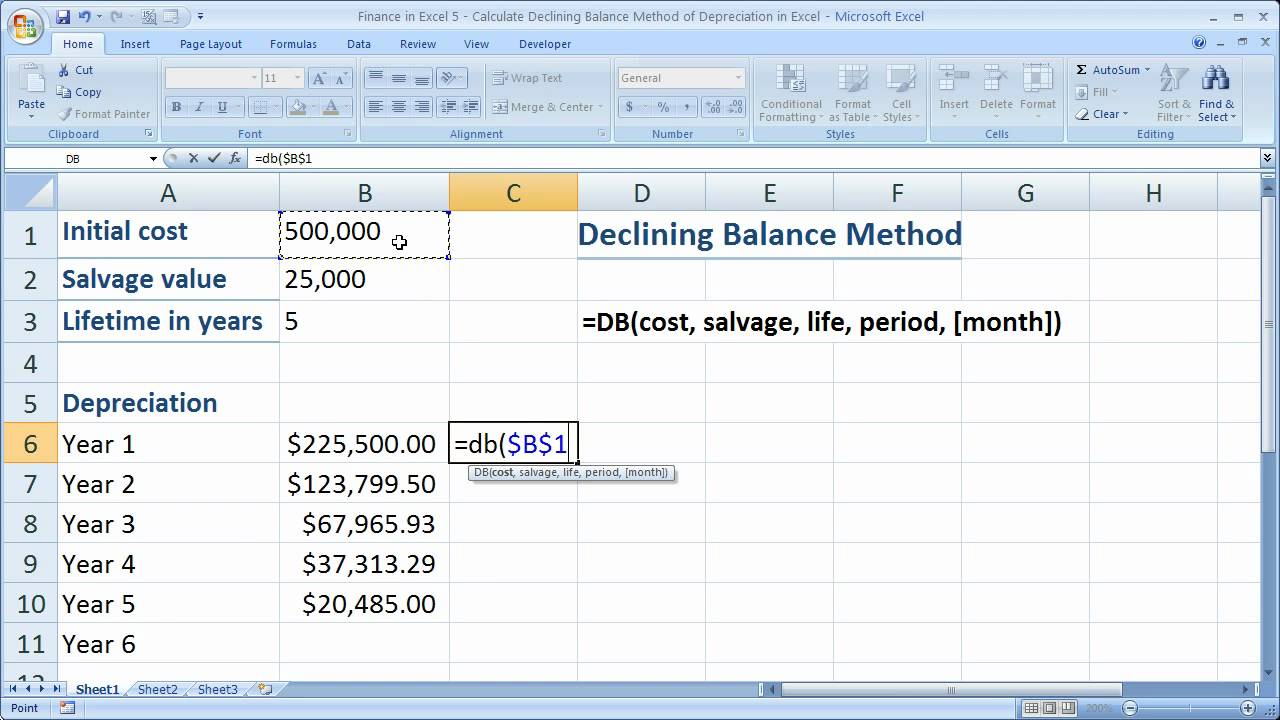

How To Calculate Declining Balance In Excel Using Formula

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Depreciation Calculator

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Formula Examples With Excel Template

Depreciation All Concepts Explained Oyetechy

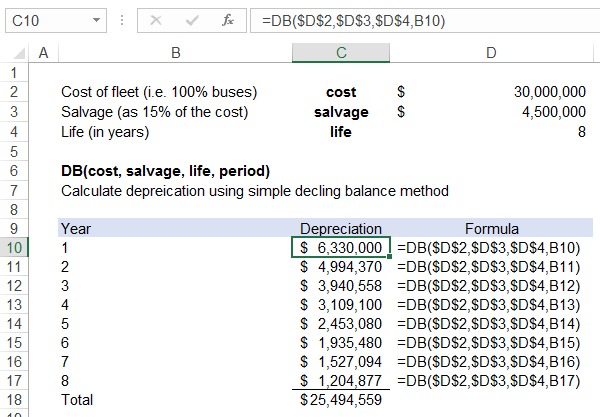

How To Use The Excel Db Function Exceljet

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Declining Balance Depreciation In Excel Example

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Calculator

Finance In Excel 5 Calculate Declining Balance Method Of Depreciation In Excel Youtube

Declining Balance Method Of Depreciation Formula Depreciation Guru

Depreciation Formula Calculate Depreciation Expense